Indian stock market mein invest karna kaafi rewarding ho sakta hai, especially agar aap beginner hain aur wealth build karna chahte hain. Lekin, iske liye kuch basic concepts, strategies aur market environment ka samajh hona zaroori hai. Is blog mein, hum aapko step by step guide karenge.

How to Invest in Indian Stock Market for Beginners

Table of Contents

ToggleStock Market ka Introduction

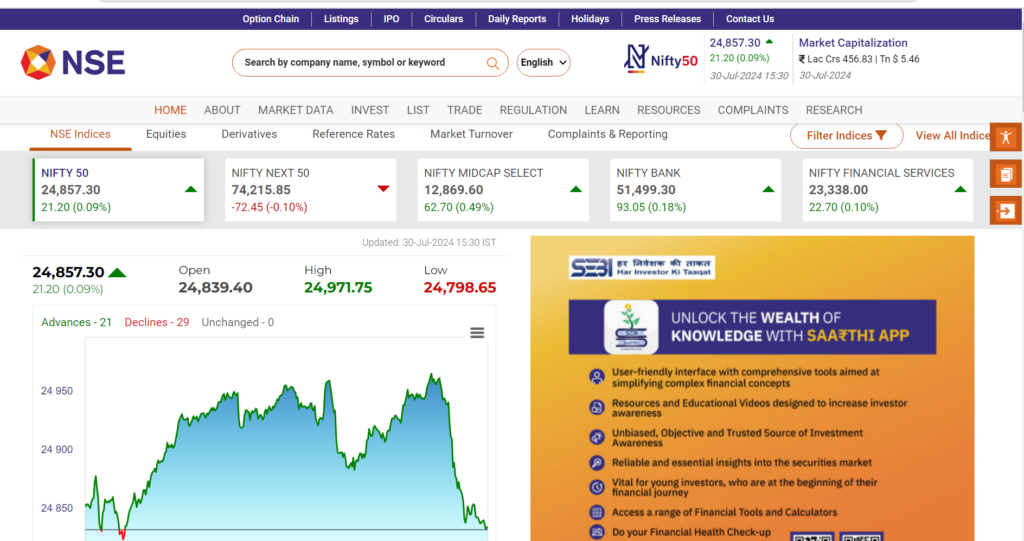

Stock market ek aisa platform hai jahan publicly listed companies ke shares trade hote hain. India mein, do primary stock exchanges hain: Bombay Stock Exchange (BSE) aur National Stock Exchange (NSE). Stock market companies ko capital raise karne ka mauka deta hai aur investors ko un companies ka ek hissa own karne aur unke growth se benefit lene ka chance milta hai.

How to Invest in Indian Stock Market for Beginners?

-

- Wealth Creation: Historically, stock market ne higher returns deliver kiye hain compared to other investment options like fixed deposits aur bonds.

-

- Ownership: Shares kharidne se aap company ka ek part own karte hain.

-

- Liquidity: Stocks highly liquid hote hain, jo aapko jaldi se buy aur sell karne ki flexibility dete hain.

-

- Diversification: Aapke investment portfolio ko diversify karne ka ek tarika hai.

Stock Market Investment Shuru Karna

Step 1: Basics Samajhna

Dive karne se pehle, kuch basic concepts ko samajh lein jaise shares, stock exchanges, indices (Nifty 50, Sensex), IPOs, dividends, aur market capitalization.

Step 2: Open a Demat and Trading Account

Trading start karne ke liye aapko ek Demat aur trading account kholna padega ek SEBI-registered broker ke sath. Demat account aapke shares ko electronic format mein hold karta hai, jabki trading account buying aur selling ke liye use hota hai.

Step 3: Research aur Analysis

Research bahut zaroori hai. Fundamental aur technical analysis ka use karke stocks evaluate karen:

-

- Fundamental Analysis: Yeh company ki financial health, performance aur growth prospects ko evaluate karta hai. Key metrics mein P/E ratio, earnings per share (EPS), aur return on equity (ROE) shamil hain.

-

- Technical Analysis: Price charts aur market data ko study karke trends identify karne aur trading decisions lene mein help karta hai.

Step 4: Blue-chip Stocks se Start Karen

Beginners ke liye blue-chip stocks se start karna advisable hai. Yeh well-established companies hoti hain jinke stable performance ka ek history hota hai, jaise Reliance Industries, TCS, aur HDFC Bank.

Step 5: Diversify Your Portfolio

Apne saare paise ek stock ya sector mein mat dalen. Diversification risk ko reduce karta hai by spreading investments across different sectors aur stocks.

Step 6: Monitor Your Investments

Regularly apne portfolio ko review karen aur performance ko track karen. Market news aur company fundamentals mein changes se updated rahein.

Step 7: Stay Disciplined

Stock market investment patience aur discipline demand karta hai. Market volatility ya rumors ke basis par impulsive decisions avoid karen.

Beginners ke Liye Investment Strategies

Long-term Investment

Stocks mein long term (5-10 saal) tak invest karna market volatility ko ride out karne aur companies ke growth potential se benefit lene mein madad karta hai.

Systematic Investment Plan (SIP)

SIP aapko fixed amount ko regularly invest karne ka mauka deta hai, jo rupee cost averaging aur disciplined investment mein madad karta hai.

Dividend Investing

Un companies mein invest karen jo dividends pay karne ka ek history rakhti hain. Yeh aapko ek regular income stream provide karta hai in addition to potential capital gains.

Value Investing

Yeh strategy undervalued stocks ko pick karne mein madad karti hai jo strong fundamentals rakhte hain. Goal hai low price par khareedna aur high price par bechna.

Common Mistakes to Avoid

-

- Lack of Research: Invest karne se pehle hamesha research karen. Tips blindly follow na karen.

-

- Over-diversification: Diversification acchi baat hai, lekin over-diversification returns ko dilute kar sakti hai.

-

- Emotional Investing: Emotions ke basis par decisions lena avoid karen. Apni strategy par stick rahen.

-

- Ignoring Risk Management: Potential losses ko limit karne ke liye stop-loss orders ka use karen.

Conclusion

Investing in the Indian stock market for beginners ek rewarding journey ho sakta hai agar sahi knowledge aur strategy ke sath approach kiya jaye. Basics ko samajhna, Demat aur trading account kholna, thorough research karna aur disciplined approach adopt karna shuruat ke kuch important steps hain. Yaad rakhen, patience aur continuous learning successful stock market investing ke keys hain.

Internal Links

External Links

1 thought on “How to Invest in Indian Stock Market for Beginners”