Dividend-paying stocks in India 2024 investors ke liye kaafi attractive hote hain, especially for those looking for regular income along with potential capital appreciation. Is blog mein, hum discuss karenge kuch best dividend-paying stocks in India 2024, jo aapke portfolio ko stable returns aur consistent income provide kar sakte hain.

Table of Contents

ToggleDividend-Paying Stocks ka Funda

Dividend-paying stocks woh hote hain jo apni earnings ka ek portion shareholders ko regular intervals pe distribute karte hain. Dividends investors ke liye ek passive income source create karte hain, aur unko ye assurance dete hain ki company financially stable hai.

Kyun Invest Karein Dividend-Paying Stocks Mein?

- Regular Income: Dividends provide a regular income stream, jo retired individuals ya income-seeking investors ke liye kaafi beneficial hota hai.

- Stability: Generally, dividend-paying companies financially strong aur well-established hote hain.

- Tax Benefits: Dividends pe milne wale tax benefits investors ke returns ko aur enhance karte hain.

- Inflation Hedge: Dividend growth stocks help karte hain inflation se fight karne mein kyunki inka payout time ke sath increase hota rehta hai.

Best Dividend-Paying Stocks in India 2024

1. Hindustan Unilever Limited (HUL)

Kyon HUL?: HUL ek leading FMCG company hai jo consistent dividends pay karti hai. Inka diversified product portfolio aur strong market presence inhe ek reliable dividend stock banate hain.

Dividend Yield: 1.5% – 2%

Growth Catalysts: Rural demand growth, innovative product launches, aur digital transformation.

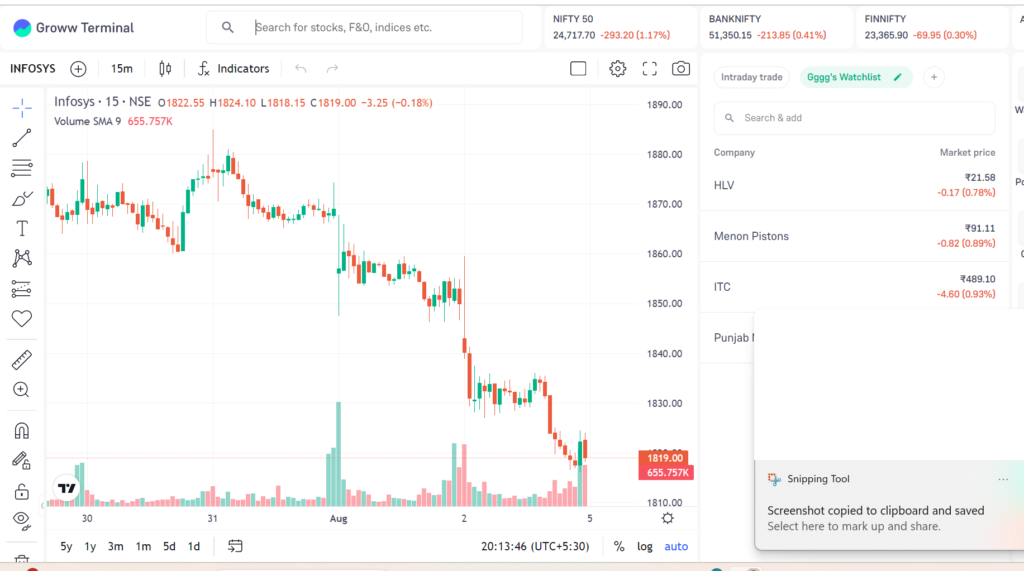

2. Infosys Limited

Kyon Infosys?: Infosys ek leading IT services provider hai jo regular dividends aur occasional special dividends pay karti hai. Inka robust business model aur consistent financial performance isse ek attractive option banata hai.

Dividend Yield: 2% – 2.5%

Growth Catalysts: Digital transformation, cloud computing, aur artificial intelligence services.

External Link: Infosys Official Website

3. Indian Oil Corporation Limited (IOCL)

Kyon IOCL?: IOCL ek major player hai oil and gas sector mein aur inka dividend payout kaafi attractive hota hai. Yeh company government-backed hai, jo iski stability ko aur enhance karta hai.

Dividend Yield: 7% – 8%

Growth Catalysts: Increasing energy demand, new refinery projects, aur international expansion.

4. Coal India Limited

Kyon Coal India?: Coal India, ek government-owned coal mining corporation, consistent high dividends pay karti hai. Inka monopoly status aur government support inhe ek reliable dividend stock banate hain.

Dividend Yield: 8% – 9%

Growth Catalysts: Rising domestic coal demand, new mining projects, aur operational efficiency improvements.

5. ITC Limited

Kyon ITC?: ITC ek diversified conglomerate hai jiska major revenue FMCG, hotels, paperboards, and packaging businesses se aata hai. Yeh company consistent aur high dividends pay karti hai.

Dividend Yield: 4% – 5%

Growth Catalysts: FMCG segment ka expansion, cost-cutting measures, aur hotel business ka recovery.

Investing in Dividend-Paying Stocks: Steps to Follow

Step 1: Research Aur Analysis

Aapko dividend-paying stocks mein invest karne se pehle thorough research aur analysis karna chahiye. Fundamental analysis ko samjhe aur company ke financial health, payout ratio, aur dividend history ko evaluate karein.

Step 2: Diversify Your Portfolio

Apne investments ko diversify karen by including stocks from different sectors. Isse risk minimize hota hai aur aapko consistent income milti rahti hai.

Step 3: Long-term Investment Approach Adopt Karen

Dividend-paying stocks mein long-term investment approach adopt karna better hota hai. Aise stocks time ke sath grow karte hain aur aapko compounded returns aur growing dividends provide karte hain.

Step 4: Reinvest Your Dividends

Agar possible ho toh apne dividends ko reinvest karen. Yeh aapke returns ko compound karne aur wealth creation ko boost karne mein madad karta hai.

Step 5: Regular Monitoring

Regularly apne portfolio ko monitor karna zaroori hai. Market changes aur company-specific developments ko follow karein aur apni investment strategy accordingly adjust karen.

Common Mistakes to Avoid

- Ignoring Company Fundamentals: Sirf high dividend yield dekhkar invest mat karen. Company ke fundamentals aur financial health ko bhi evaluate karna zaroori hai.

- Overlooking Growth Potential: Dividend yield ke sath-sath company ke future growth prospects ko bhi consider karen.

- Not Diversifying Enough: Apne portfolio ko diversify karna na bhulein to mitigate risks.

Conclusion

Dividend-paying stocks in India 2024 mein invest karna ek smart strategy ho sakti hai for generating regular income and achieving long-term financial goals. Hindustan Unilever, Infosys, Indian Oil Corporation, Coal India, aur ITC jaise stocks stable returns aur consistent dividends offer karte hain. Always remember to do your own research, diversify your portfolio, and stay invested for the long-term to reap the maximum benefits.

Internal Links

- How to invest in indian stock market for beginners 2024

- Best Blue-Chip Stocks for Long-Term Investment

External Links

By following these steps, aap dividend-paying stocks se consistent income aur potential capital appreciation achieve kar sakte hain. For more detailed guides and expert tips, visit StockMoneyHub.